is yearly property tax included in mortgage

The property tax is usually included in the mortgage payments together with the homeowners insurance interest and principal. The payment is principal and interest only.

Solved Suppose You Take Out A 20 Year Mortgage For A House That Costs Course Hero

Mortgage And Property Tax.

. The answer to that usually is yes. Heres how you pay property taxes as part of your mortgage payment. Property taxes can be included in your mortgage payment at your option if your loan-to-value LTV ratio is less than 80.

This should answer your question are property taxes. If your county tax rate is 1 your property tax bill. If your county tax rate is 1 your property tax bill will come out to 2000 per.

To get the total monthly payment for down payments below 20 add in your property taxes homeowners insurance and private mortgage. Your lender will collect this with your monthly mortgage payment. While this may make your payments larger itll allow you to avoid paying a thousand dollars or more in one.

All you have to do is take your homes assessed value and multiply it by the tax rate. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes. The mortgage the homebuyer pays one year can increase the following.

Lets say your home was worth 200000 last year and the tax rate was 2. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount.

With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a. Because it saves first-time home buyers from the burden of paying property tax in one installment and also protects them from. Your mortgage payment is likely to stay.

Yes property taxes are included in FHA mortgage payments. Lets say your home has an assessed value of 100000. Answer 1 of 4.

If you get a home loan. You owed 4000 last year in property taxes. Are Property Taxes Included In Mortgage Payments.

Look in the total payment- It. If you qualify for a 50000. Your monthly payment includes your mortgage payment consisting of principal and interest as well as property taxes and homeowners insurance.

While property taxes may seem expensive the good news is you can deduct them from your federal income taxes. Most likely your taxes will be included in your monthly mortgage payments. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats.

You pay your property taxes with your monthly mortgage payment if you choose escrow during the loan financing process. Your property taxes are included in your monthly home loan payments. Lets say your home has an assessed value of 100000.

This year your tax rate stays the same at 2 but your home is now. Property taxes are usually paid twice a yeargenerally March 1 and September 1and are paid in advance. Most mortgage lenders calculate monthly fees by dividing your.

The Tax Cuts and Jobs Act enforced a 10000 cap for married couples. Lets say your home has an assessed value of 200000. So if youre putting down 20 or more on a purchase.

Assessed Value x Property Tax Rate Property Tax. The second option is to have your lender collect a portion of your property taxes from you every month. Property taxes are included as part of your monthly mortgage payment.

The amount each homeowner pays per year varies depending on local tax rates and a propertys assessed value. It will then give your. Paying property taxes is inevitable for homeowners.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Mortgages Vs Home Equity Loans What S The Difference

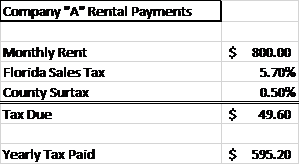

How To Calculate Fl Sales Tax On Rent

Property Taxes Department Of Tax And Collections County Of Santa Clara

Help Is Available For Homeowners Behind In Paying Mortgage Property Taxes Or Utility Payments New Hampshire Municipal Association

Homebuyers Pay Attention To The Property Tax Rate Baker Realty

The Mortgage Interest Deduction Explained Mortgage 1 Inc

Is Property Tax Included In My Mortgage Moneytips

Loan Estimate Explainer Consumer Financial Protection Bureau

Is Property Tax Included In Your Mortgage Rocket Mortgage

Secured Property Taxes Treasurer Tax Collector

Understanding Closing Costs Sirva Mortgage

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Property Tax Calculator Estimator For Real Estate And Homes

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

What You Should Know About Property Taxes In California Nicki Karen